Problem statement

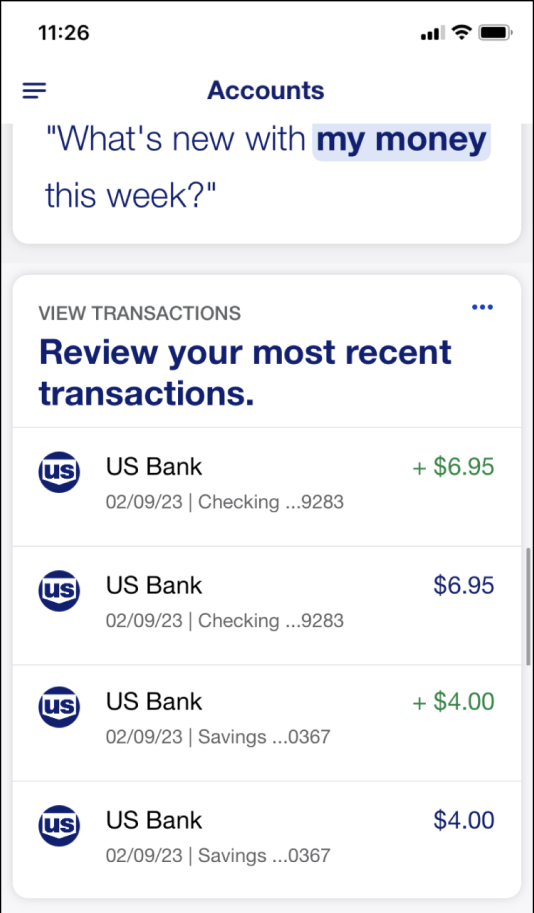

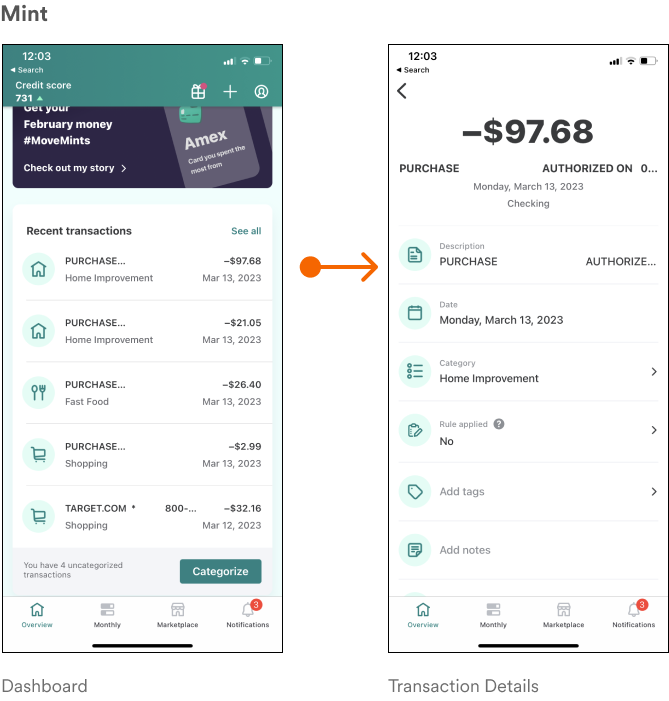

The current recent transactions don’t provide any helpful product recommendations or offers to help customers grow their money.

Scope

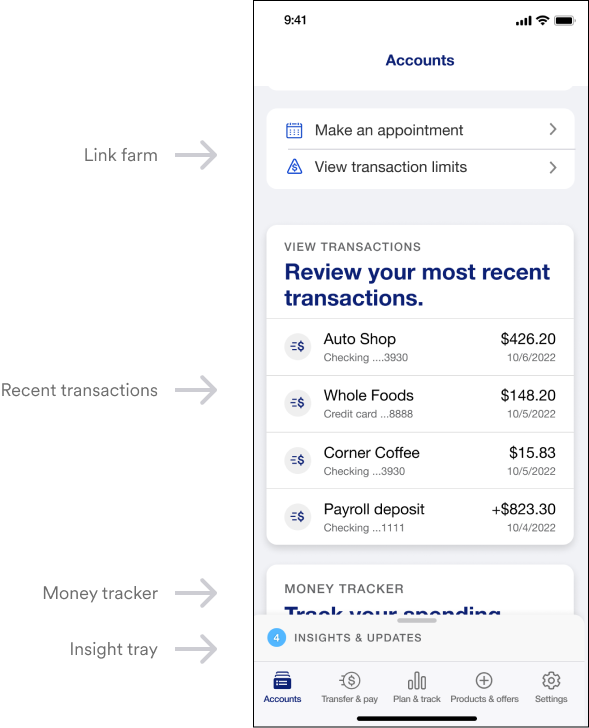

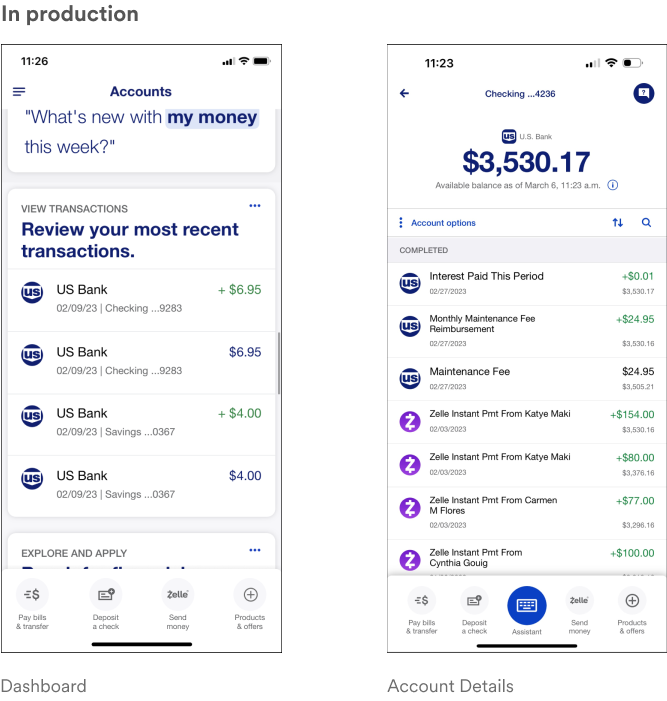

Recent Transactions in-line offer template for the native dashboard.

Related projects

Responsive Web: Recent transactions update

Responsive Web: In-line offers

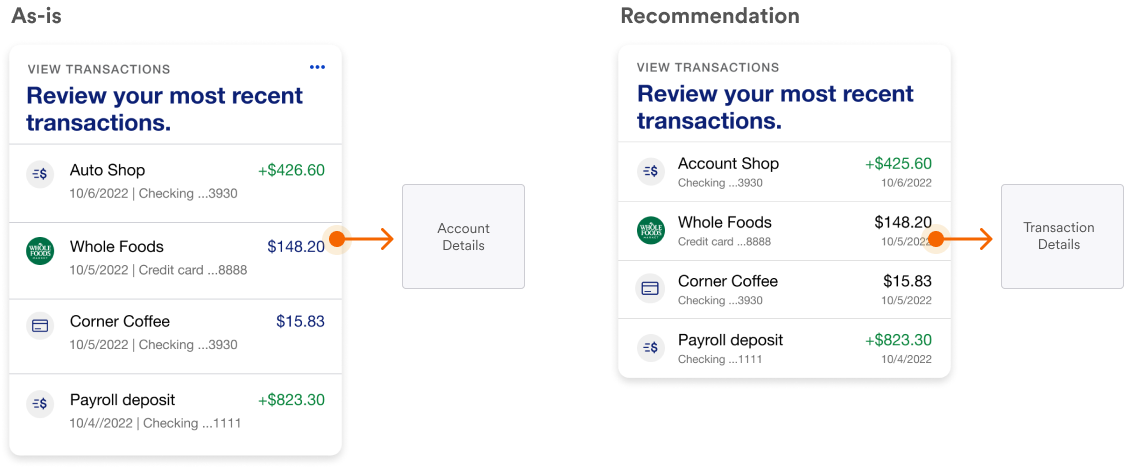

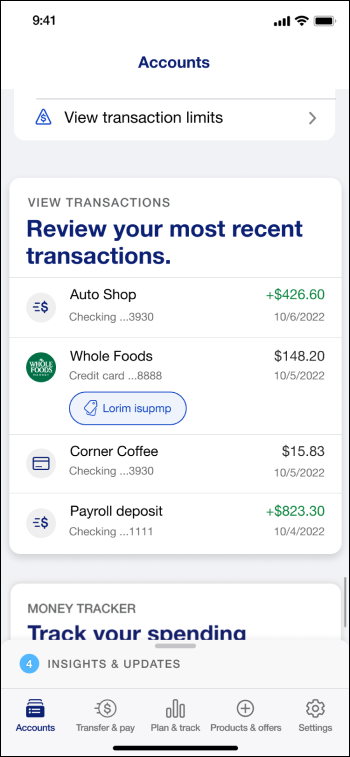

Deltas

There were seven types of deltas:

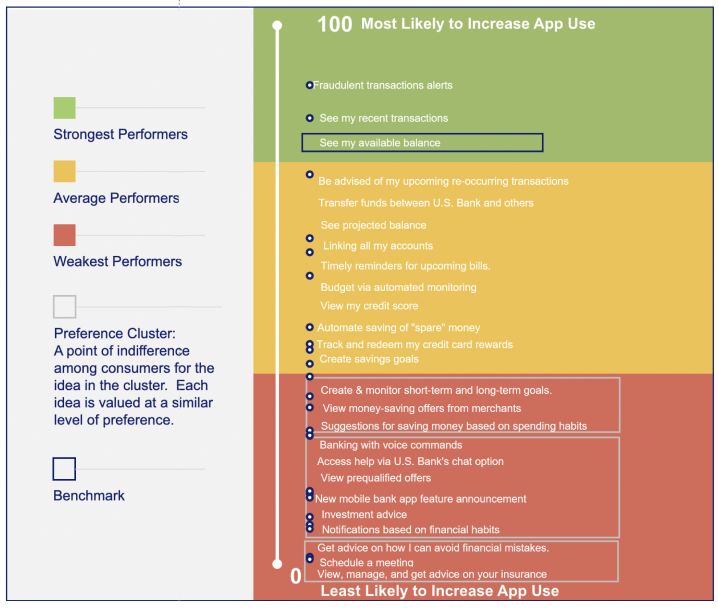

Key findings

Key findings

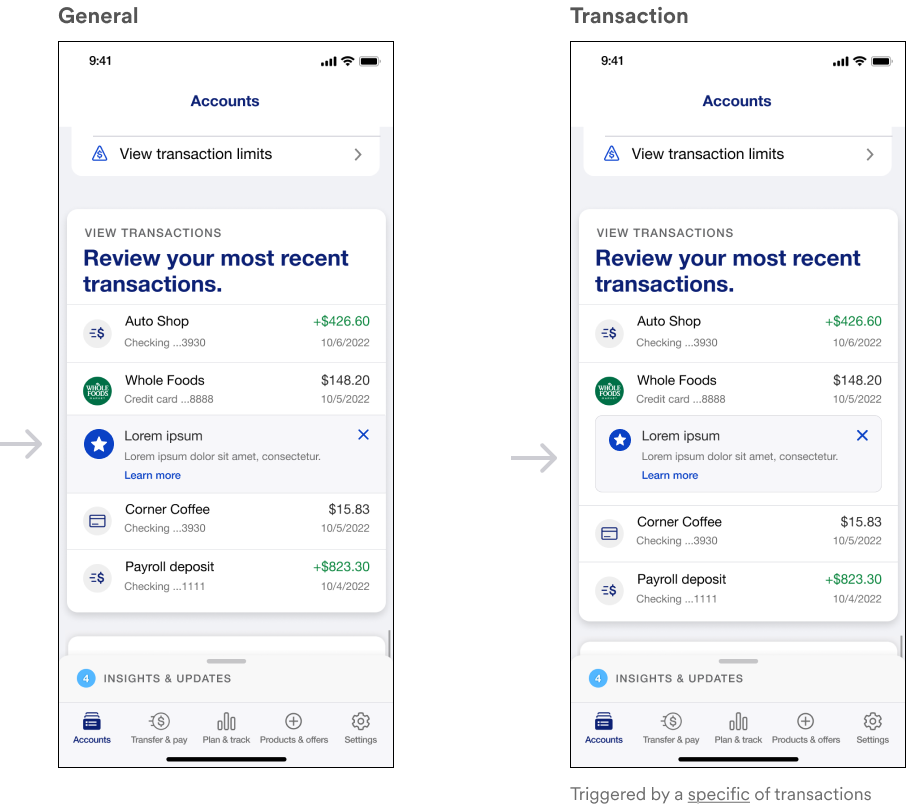

Transaction in-line offers

Other

In four studies between 2020 to 2022, recent transactions were repeatedly identified as one of the top five reasons a user would visit the app.

Pros

Cons

Pros

Cons

Pros

Cons

Enhance the existing component by resolving deltas & align with users’ expectations.